Cybersecurity market in India to reach $3 billion by 2022: DSCI-PwC Report

With increasing technological advancements in India, the vulnerabilities in these technologies have also increased causing it to be exploited by threat experts of the cyber world for their own benefit. Cyberattacks across organizations involving phishing, malware and more have placed the critical information of governments, organizations and individuals at constant risk.

Thus, cybersecurity is gaining more attention than ever, not just in the news but also among industry leaders, policy makers and the public.

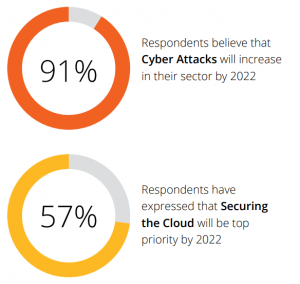

According to the estimates released by DSCI and PwC, the cybersecurity market in India is expected to reach an annual growth of 15.6% from USD 1.97 billion in 2019 to USD 3.05 billion by 2022, which is 1.5 times more than the global security market.

What are the main factors necessitating cybersecurity investments?

The report investigated the main reasons behind the high growth of cybersecurity in India. The factors contributing to this growth rate are:

- Digital empowerment of the citizens by national and state level e-governance initiatives. Technology drivers involved Cloud computing, availability of information through devices, real-time information gathering via analytics, and more.

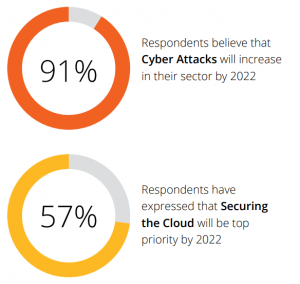

- The attack on cyber security systems has increased about 292% in just two years, from 53,081 in 2017 to 2,08,456 in 2018. When surveyed, 91% respondents believed the cyber security incidents will increase in their sector by 2022.

- Increasing regulatory norms across sectors.

ALSO READ: Companies investing in privacy programs get best returns: Cisco report

Key industry analysis

The cybersecurity market in India will be defined by top three sectors including banking and financial services industry (BFSI), information technology (IT) and information technology enabled services (ITeS), and the government, the report estimated. Other industries apart from the ones mentioned here include energy, healthcare and automobile.

Overall, these sectors will account for 68% of the cyber market share. Some facts on the key sectors profiled in the report are:

-

BFSI Sector

BFSI sector is taking various steps to protect their IT infrastructure. It is divided into insurance companies, banking, and other financial institutions. According to the report, this sector has the highest investment (26%) in cyber security market. The main factors responsible for the drive involve technology adoption, increase in digital payments (annual growth – 20.2%), increased guidelines and regulations, and cyber attacks highly focused on core banking systems.

-

IT/ITES Sector

“The IT/ITeS sector is witnessing increased awareness on user privacy and is preparing for further regulations on data privacy,” as per the report.

42% respondents said that the main cause of cyber incidents in this industry is due to weak access control mechanism. Overall, this sector is expected to increase its spending on cyber security from USD 434 million in 2019 to USD 713 million by 2022.

-

Government Sector

India is among the top nations in ransomware attacks, and governments are constantly under the threat of cyberattacks all over the world. As per the same report, government in India is making strong commitment and steps to address cybersecurity issues. It is expected to invest USD 581 million by 2022.

Apart from these, healthcare is another major sector most affected by cyber crimes and is actively investing to address the issue by adopting e-health standards as well as security tools to protect electronic health data.

Apart from these, healthcare is another major sector most affected by cyber crimes and is actively investing to address the issue by adopting e-health standards as well as security tools to protect electronic health data.

Cybersecurity products and services’ analysis

Some of the key findings are:

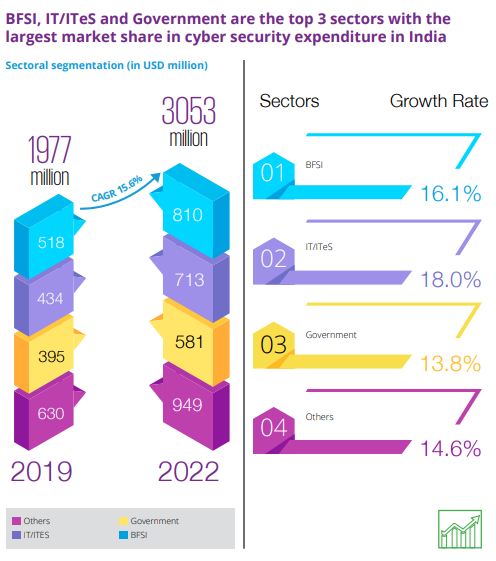

Cybersecurity products

- Data security products are growing at the fastest rate (22.2%) driven by emphasis on privacy and confidentiality.

- Endpoint security products such as anti-virus and anti-spam software, exploit protection, continuous monitoring, etc. are growing fast driven by concern among business executives to protect high-profile endpoints. There is high demand for real-time endpoint attack detection software, due to which there is going to be an increase in the endpoint detection and response (EDR) solutions.

- The IDR products will continue to be the most dominant product in the cyber security market at 32% of the product mix.

Cybersecurity services

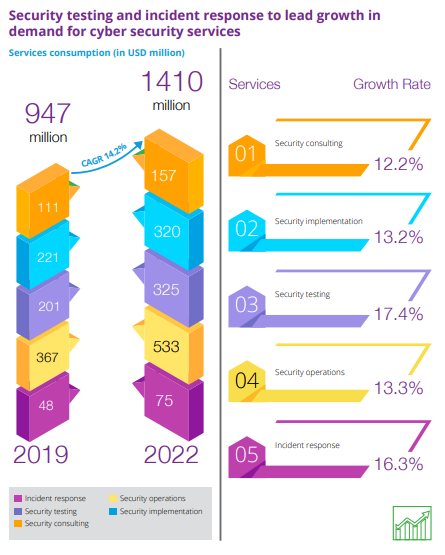

- Security testing services involving penetration testing, web testing, application security, audits and reviews is expected to grow at the fastest rate (17.4%) as businesses are willing to prevent their systems from cyberattacks.

- Incident response services are also growing (16.3%) due to high number and complexity in security breaches.

- Security operations services is the most dominant by occupying 38% of India’s cyber security services market.

With more than half a billion people in India going online today, the need to adopt right strategies by the government as well as the organizations is important to spot and respond to rapidly evolving cyber security threats in India.

Larger and mature organizations have already recognized the need and have incorporated additional measures to prepare systems as part of their security strategies. Both central and state governments have also taken strong initiatives to mandate cybersecurity to protect against and respond to breaches.

Comments are closed.