Synergy Research: 2020 Data Center M&A Deal Value Passes $30B Milestone

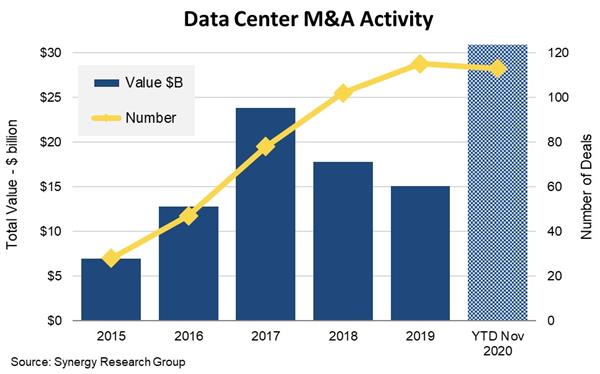

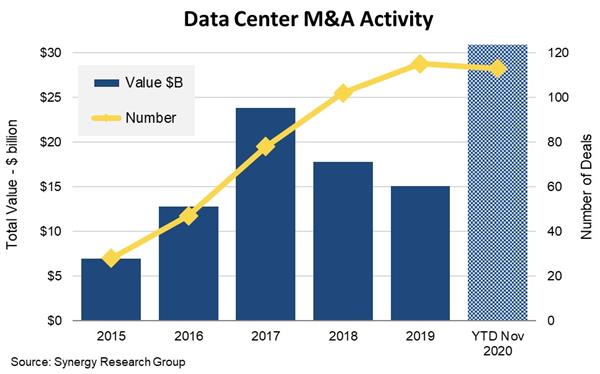

This has been a bumper year for data center M&A activity, despite COVID-19 inevitably slowing down some transactions. The value of data center-oriented M&A deals that closed in the first eleven months of 2020 blew past the $30 billion mark, far surpassing the previous annual record set in 2017, according to new data presented by Synergy Research Group.

In terms of deal volume, the final 2020 number will almost certainly pass the record number that closed in 2019. With a number of potential December deals still on the table, 2020 has so far seen 113 deals closed at a total value of $30.9 billion. While the $8.4 billion acquisition of Interxion by Digital Realty helped to boost the 2020 number, five other billion dollar-plus deals have closed so far this year, plus there was a $2 billion secondary share listing.

Since the beginning of 2015, Synergy Research has identified 483 closed deals with an aggregated value of $107 billion. Over the period the aggregated deal value has been split equally between public companies and private equity buyers, while private equity buyers have accounted for 59% of the deal volume.

Since 2015 the largest deals to be closed are the acquisitions of Interxion and DuPont Fabros by Digital Realty, the acquisition of Global Switch by a group of Chinese investors and the acquisitions of Verizon data centers and Telecity by Equinix.

Digital Realty and Equinix

Over the 2015-2020 period, by far the largest investors have been Digital Realty and Equinix, the world’s two leading colocation providers. In aggregate they account for 31% of total deal value over the period. Other notable companies who have been serial acquirers include Colony, CyrusOne, GDS, Digital Bridge/DataBank, Iron Mountain, NTT, GI Partners, Carter Validus, QTS and Keppel.

“There is no doubt that this has been a bumper year for data center M&A activity, despite COVID-19 inevitably slowing down some transaction and due diligence activities,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “We are also aware of almost $7 billion in deals and IPOs that are at various stages of closing, so the pipeline remains robust despite the flurry of activity in 2020. This drive to find new sources of investment capital is being fueled by an almost inexhaustible demand for data center capacity.”

Comments are closed.